Knowledge Base

Save us time to focus on some great new features and try our self service knowledge base. Search for anything.

Knowledge Base

Save us time to focus on some great new features and try our self service knowledge base. Search for anything.

To support the upcoming 2025 e-invoicing requirements for B2B transactions, we’ve added features in the Ultimate PDF Invoices plugin for compliance with the new e-invoicing standards: XRechnung, ZUGFeRD, and Factur-X. Below, we answer common questions and explain the new settings and options.

These are standards for electronic invoicing that enable businesses to exchange invoice data digitally in a structured XML format. This format ensures compliance with B2B invoicing regulations and promotes faster, more accurate invoice processing.

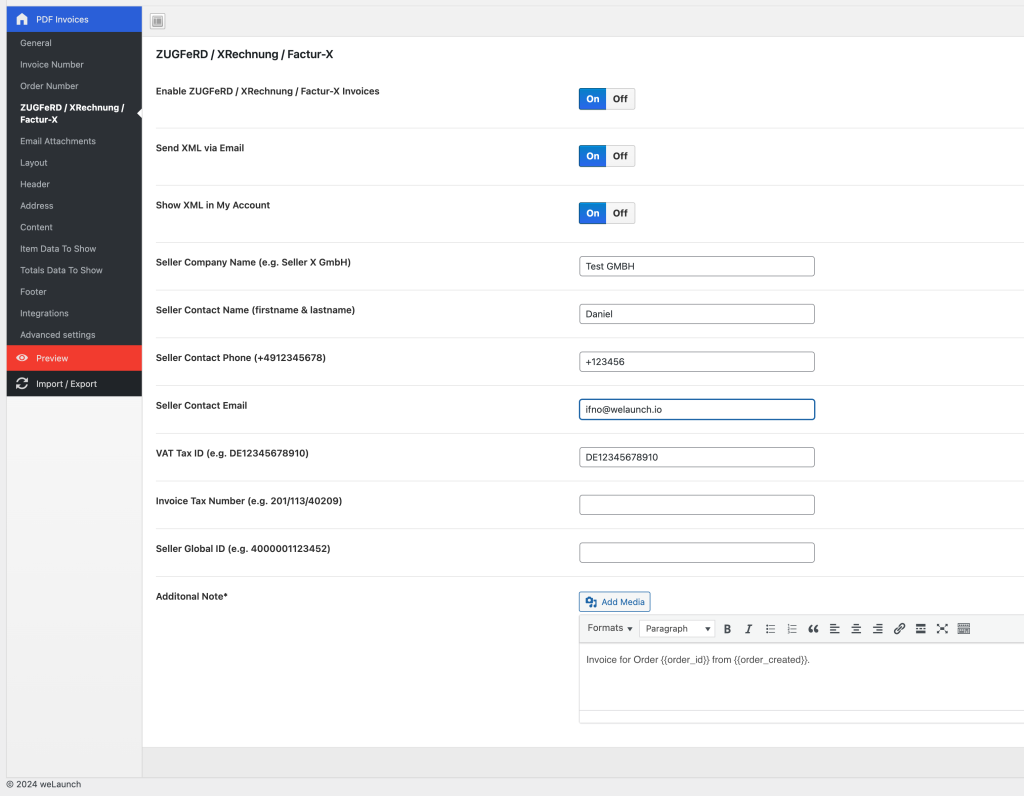

Enable ZUGFeRD / XRechnung / Factur-X Invoices

Toggle this setting to enable the generation of XML e-invoices in XRechnung, ZUGFeRD, or Factur-X format. This is essential for compliance with the latest EU e-invoicing standards for B2B transactions.

Send XML via Email

Activating this option attaches the XML e-invoice to the email sent to the customer. This allows them to import the invoice directly into compatible accounting software for streamlined processing.

Show XML in My Account

This option displays a downloadable link to the XML invoice format in the customer’s “My Account” section, making it easy for customers to access their e-invoices at any time.

Seller Company Name (e.g., Seller X GmbH)

Here, you enter your company’s legal name as it should appear on the invoice. Example: “Seller X GmbH.”

Seller Contact Name (First Name & Last Name)

Provide the primary contact’s name for the invoice. This is typically the person responsible for billing-related queries.

Seller Contact Phone

Enter your phone number for invoice inquiries. Format example: “+123456.”

Seller Contact Email

Input the contact email address where customers can reach out regarding the invoice. Example: “da**************@we******.io.”

VAT Tax ID

Include your company’s VAT Tax ID here. For instance: “DE12345678910.”

Invoice Tax Number

Some companies have a tax number specifically used for invoicing. Enter that here if applicable.

Seller Global ID

This unique global identifier is important for EU compliance in e-invoicing and is often issued by a chamber of commerce or a similar regulatory authority. Example format: “4000001123452.”

Additional Note

Add any extra notes or information here that may need to appear on all invoices, such as payment terms or specific instructions.

Did not found what you was looking for?

Please submit a ticket with a detailed explanation about your problem.

Submit TicketWhen you visit any web site, it may store or retrieve information on your browser, mostly in the form of cookies. Control your personal Cookie Services here.